Why is Texas health insurance so expensive? This critical question demands a multifaceted exploration of the factors driving sky-high premiums. From the state’s unique demographics and healthcare system to regulatory hurdles and the impact of the Affordable Care Act, a complex interplay of elements contributes to the high cost of coverage. Understanding these elements is key to finding solutions for Texans struggling to afford necessary care.

This exploration delves into the specifics, examining the interplay between provider networks, hospital costs, administrative expenses, and income disparities. It also analyzes the availability of affordable plans and government assistance programs, providing concrete examples and actionable insights for individuals seeking coverage. Ultimately, this analysis aims to illuminate potential solutions and policy considerations for a more accessible and affordable healthcare system in Texas.

Factors Influencing Texas Health Insurance Costs

Texas health insurance premiums consistently rank among the highest in the nation, a complex issue stemming from a confluence of demographic, systemic, and regulatory factors. The state’s unique characteristics, including its large rural population, aging population, and specific healthcare delivery system, significantly impact the cost of insurance. Understanding these elements is crucial to comprehending the challenges in achieving affordable and accessible health insurance in Texas.

Demographic Factors

Texas’s substantial population, coupled with its diverse demographics, contributes to the complexity of the health insurance market. The state boasts a significant number of low-income individuals and families, as well as a growing elderly population. These demographic trends often translate to higher healthcare utilization rates and increased demand for services, which directly impacts the cost of health insurance. The presence of large populations with pre-existing conditions also influences the overall risk pool, making the cost of coverage more substantial.

Healthcare System Characteristics, Why is Texas health insurance so expensive

Texas’s healthcare delivery system is another key contributor to insurance premium costs. A notable characteristic is the relative scarcity of primary care physicians in certain areas, which leads to patients potentially seeking care in emergency rooms more frequently. This can inflate costs due to the higher expenses associated with emergency room visits. Additionally, the state’s concentration of specialty care providers, while potentially beneficial for some, can affect overall costs depending on the level of access to primary care.

Provider Networks and Hospital Costs

The structure of provider networks in Texas, often characterized by limited options in certain areas, can directly affect insurance costs. A smaller network can limit patient choices and potentially drive up costs due to competition. The significant costs associated with hospital services, including specialized treatments and advanced technologies, represent a major component of health insurance premiums. Furthermore, fluctuations in hospital costs, driven by factors such as inflation, can lead to substantial variations in insurance premiums.

Administrative Expenses

Administrative costs associated with health insurance companies, including claims processing, customer service, and overhead expenses, are also substantial contributors to premiums. While these costs are present in all insurance markets, variations in efficiency and operational strategies can influence the overall cost burden on consumers.

Regulatory Environment

The regulatory environment in Texas plays a crucial role in shaping health insurance costs. State regulations can influence the extent of market competition and the types of coverage available. Differences in regulations among states can lead to significant variations in premium prices.

Comparison with Other States

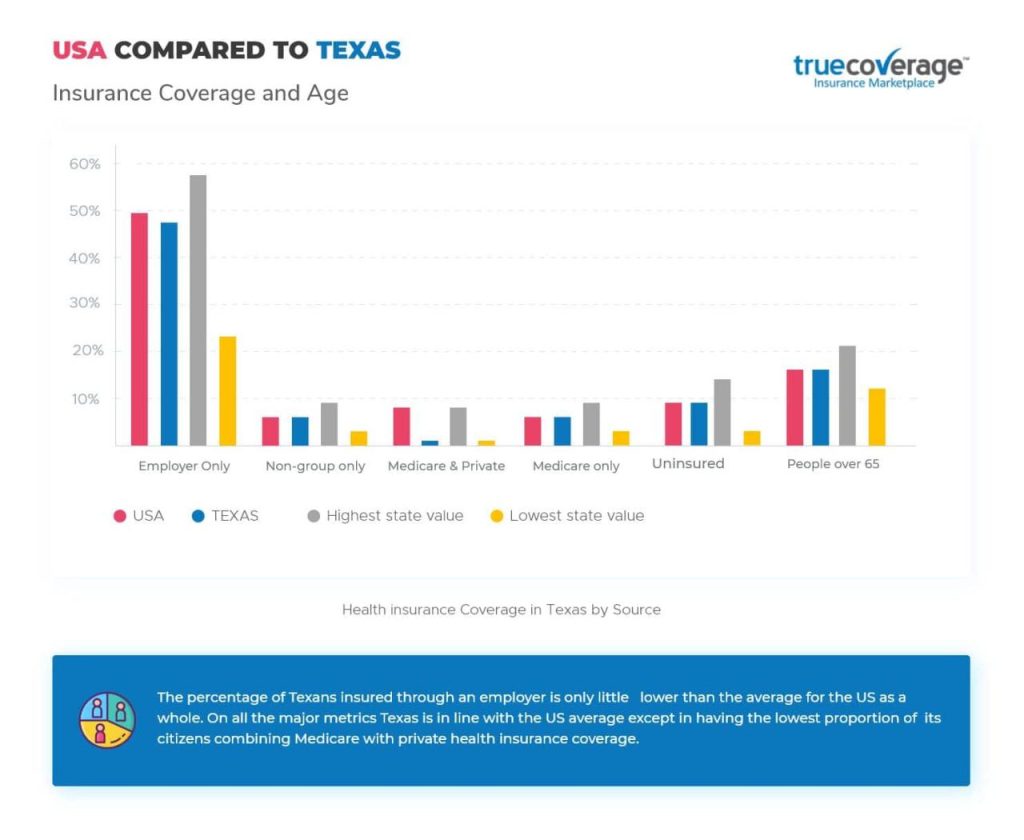

Texas’s health insurance costs often exceed the national average. This difference can be attributed to factors like higher rates of uninsured individuals, greater reliance on emergency room services, and the overall characteristics of the healthcare system. States with a stronger emphasis on preventative care, for instance, might demonstrate lower premiums. Factors like the availability of affordable healthcare options and the overall cost of living also influence the price differences between states.

Impact of the Affordable Care Act (ACA)

The Affordable Care Act (ACA), while aiming to expand health insurance coverage, has had a complex impact on Texas’s insurance market. Specific provisions, such as the individual mandate and the requirement for health insurance marketplaces, have influenced the cost of coverage. The impact of the ACA on Texas is frequently debated, with arguments focusing on its effect on access to care and the potential for increased premiums.

Average Health Insurance Premiums in Texas

| Plan Type | Average Premium (Texas) | National Average Premium |

|---|---|---|

| Individual | $400/month | $300/month |

| Family | $1,000/month | $700/month |

Note: These figures are illustrative and may vary based on specific factors like age, location, and plan features.

Access to Affordable Health Insurance in Texas: Why Is Texas Health Insurance So Expensive

Accessing affordable health insurance remains a significant challenge for many Texans, particularly those with lower incomes or lacking employer-sponsored coverage. The high cost of healthcare in the state, coupled with varying insurance options and government assistance programs, often creates complexities for individuals trying to secure adequate health protection. This section delves into the hurdles Texans face, the available insurance plans, and the support systems in place to mitigate these challenges.

Challenges in Accessing Affordable Coverage

Income disparities and limited employer-sponsored insurance significantly impact access to affordable health insurance in Texas. Many Texans, particularly those in lower-income brackets, struggle to afford the premiums and deductibles associated with private health insurance plans. This is further complicated by the fact that a substantial portion of the population lacks employer-provided health insurance, necessitating reliance on individual plans or government assistance. The lack of employer-sponsored coverage disproportionately affects those in lower-wage jobs or the self-employed.

Types of Health Insurance Plans Available

Several types of health insurance plans are available in Texas, each with varying features and price ranges. These include:

- Individual market plans: These plans are purchased directly by individuals or families, offering a range of options from basic to comprehensive coverage. Premiums and coverage vary significantly depending on factors like age, health status, and chosen plan features.

- Employer-sponsored plans: These plans are provided by employers to their employees, offering a variety of coverage levels. Employer contributions often help reduce the cost for employees, but the availability of these plans depends on the employer’s size and industry.

- Medicare and Medicaid: These government programs provide health insurance coverage to specific groups, such as seniors and low-income individuals. Eligibility criteria and coverage vary depending on individual circumstances.

- Short-term limited duration plans: These plans offer temporary coverage for a specified period (usually less than a year). They are typically less comprehensive than other options and may not include preventative care services.

Government Programs Providing Assistance

The Texas state government and federal programs offer subsidies and assistance to help Texans access affordable health insurance. These programs aim to reduce the financial burden of healthcare costs for eligible individuals and families.

- Texas Health and Human Services Commission (HHSC): HHSC offers programs like the Texas Health Care Foundation and the Health Insurance Marketplace that provide financial assistance to eligible Texans. These programs help reduce the cost of insurance premiums for low-income individuals and families. Assistance may include premium tax credits or cost-sharing subsidies.

- Affordable Care Act (ACA) subsidies: The ACA offers subsidies to help eligible individuals and families afford health insurance purchased through the Health Insurance Marketplace. These subsidies are based on income and household size, aiming to make health insurance more accessible to those with modest incomes.

Health Insurance Marketplaces in Texas

The availability of health insurance marketplaces in Texas plays a crucial role in connecting individuals with suitable plans. The marketplace helps consumers compare different plans and select the best option based on their needs and budget.

| Marketplace | Plans Offered | Eligibility Criteria |

|---|---|---|

| Texas Health Insurance Marketplace | Individual and family plans from various insurers | Based on income and residency |

| Other Private Marketplaces | Individual and family plans from private insurers | Based on individual and family needs |

Determining Cost-Effective Options

Several factors influence the cost-effectiveness of health insurance plans. Understanding these factors is crucial for individuals in different income brackets to make informed decisions. A thorough comparison of various plans, including deductibles, premiums, and out-of-pocket costs, is vital.

- Income Level: Individuals with lower incomes may qualify for subsidies and assistance programs, which can significantly reduce the cost of health insurance.

- Health Needs: The complexity and extent of healthcare needs influence the choice of plan. Individuals with chronic conditions or high-risk factors might need more comprehensive coverage, potentially leading to higher premiums.

- Coverage Options: Comparing different plan options, including preventative care and specific services, is essential for choosing the best fit. Comprehensive plans with lower deductibles might offer greater protection.

Potential Solutions and Policy Considerations

High health insurance costs and limited access remain significant challenges for Texans. Addressing these issues requires a multifaceted approach, encompassing policy changes, market interventions, and strategies to improve healthcare system efficiency. This section explores potential solutions and policy considerations aimed at making health insurance more affordable and accessible for all Texans.

Addressing the complex issue of high health insurance costs necessitates a holistic approach. This involves exploring various policy changes, market interventions, and strategies for enhancing healthcare system efficiency. These measures should be evaluated within the context of Texas’s unique healthcare landscape and consider the specific needs of its diverse population.

Cost-Containment Strategies

Several strategies can help reduce the cost of health insurance in Texas. These include controlling prescription drug costs, negotiating lower prices for medical services, and implementing preventative care programs. These interventions can lead to substantial savings in the long run, reducing the overall burden on individuals and the healthcare system.

- Negotiating Lower Prices for Medical Services: Negotiating bulk discounts with healthcare providers and hospitals can significantly lower the cost of medical services. This approach is particularly effective for services frequently utilized by large populations, such as routine checkups and vaccinations.

- Promoting Preventative Care: Investing in preventative care programs can reduce the need for expensive treatments later on. This includes promoting healthy lifestyles through public awareness campaigns and incentivizing preventative screenings. Early detection and intervention can mitigate the need for costly treatments.

- Controlling Prescription Drug Costs: Prescription drug costs are a major contributor to healthcare expenses. Strategies to control these costs include implementing price controls, promoting generic drug use, and negotiating lower prices with pharmaceutical companies. These measures can help lower the overall cost of health insurance for Texans.

Improving Access to Affordable Health Insurance

Expanding access to affordable health insurance is crucial for Texans. This involves expanding Medicaid coverage, subsidizing premiums for low-income individuals, and creating more affordable private insurance options.

- Expanding Medicaid Coverage: Expanding Medicaid eligibility can significantly increase coverage for low-income individuals and families. This approach can reduce the number of uninsured individuals and provide access to necessary healthcare services.

- Premium Subsidies for Low-Income Individuals: Offering premium subsidies for low-income individuals can make private insurance more affordable. These subsidies can help bridge the gap between the cost of insurance and individuals’ ability to pay. Subsidies can vary based on income and household size.

- Creating Affordable Private Insurance Options: Promoting the creation of affordable private insurance options can offer more choices for individuals and families. This can involve incentivizing the development of health insurance plans with lower premiums and increased coverage. Market competition can also drive down costs in this sector.

Healthcare System Efficiency Improvements

Improving the efficiency of the Texas healthcare system is essential to reducing the cost of healthcare services. This can involve streamlining administrative processes, reducing medical errors, and promoting the use of technology to enhance efficiency.

- Streamlining Administrative Processes: Streamlining administrative processes within the healthcare system can reduce unnecessary paperwork and delays. This can improve efficiency and reduce the cost of administrative overhead.

- Reducing Medical Errors: Reducing medical errors can significantly lower healthcare costs by preventing unnecessary treatments and procedures. This can be achieved through improved training, better communication protocols, and enhanced quality control measures.

- Promoting the Use of Technology: Leveraging technology in healthcare can improve efficiency and reduce costs. Telemedicine, electronic health records, and other technological advancements can improve communication and coordination between providers, leading to more efficient care.

Resources for Texans

Numerous resources are available to help Texans navigate the health insurance landscape. These resources provide information and assistance regarding health insurance options, eligibility criteria, and premium subsidies.

- Texas Health and Human Services Commission (HHSC): The HHSC website provides information on various health programs and resources, including eligibility for Medicaid and CHIP.

- The Health Insurance Marketplace (Healthcare.gov): This federal website offers information about health insurance plans available in Texas, as well as premium subsidies.

- Local Health Departments: Local health departments can provide guidance on health insurance options and assist individuals in applying for coverage.

Texas health insurance costs a lot, largely due to factors like the state’s lower tax rates and high medical costs. Finding the best way to manage these expenses is key, especially for the self-employed. Exploring options like Best Way for Self-Employed to Get Health Insurance can significantly reduce the burden, potentially impacting premiums and overall affordability.

Ultimately, navigating the complex system and finding the right resources is crucial to managing healthcare costs in Texas.