What is the cheapest but best health insurance? Finding affordable coverage without sacrificing essential benefits is a significant challenge. This guide dives deep into the world of health insurance, exploring various plans, comparing costs, and uncovering strategies to reduce premiums while maintaining comprehensive coverage. We’ll examine different types of plans, analyze factors influencing cost, and provide actionable steps to help you navigate the complex health insurance marketplace.

We’ll analyze different plans, breaking down premiums, coverage, and deductibles to help you understand the financial implications. We’ll also provide a clear roadmap to finding the right plan, featuring resources and steps to compare plans effectively. Furthermore, you’ll discover valuable strategies for lowering costs, including negotiation tactics and financial assistance programs.

Understanding Affordable Health Insurance Options

Navigating the world of health insurance can feel overwhelming. Different plans offer varying levels of coverage and cost, making it crucial to understand the available options and how they fit your needs. This exploration will delve into the diverse landscape of health insurance plans, emphasizing the factors impacting cost and providing concrete examples for clarity.

Health insurance plans are designed to help individuals and families manage healthcare costs. Understanding the spectrum of options available, from basic to comprehensive plans, is key to selecting the most suitable coverage. This process requires a clear understanding of factors influencing cost, such as location, age, and pre-existing conditions.

Different Health Insurance Plan Types

Various health insurance plans cater to different needs and budgets. These plans are categorized based on the extent of coverage they provide. Basic plans typically cover essential services, while comprehensive plans offer broader protection, including preventative care and a wider range of treatments. The specific benefits and costs vary significantly between these plan types.

- Basic Plans: These plans often have lower premiums but may have higher out-of-pocket costs, such as deductibles and co-pays. They typically cover essential services, like doctor visits and emergency care. Basic plans are a good choice for individuals with predictable healthcare needs and a willingness to manage costs directly.

- Bronze Plans: Bronze plans provide a balance between cost and coverage. They generally have moderate premiums and moderate out-of-pocket expenses. These plans are a middle-ground option, suitable for individuals who seek a reasonable balance between affordability and comprehensive care.

- Silver Plans: Silver plans offer a wider range of benefits and higher coverage compared to bronze plans, but the premiums are also higher. They provide a good mix of coverage and cost, making them a popular choice for many.

- Gold Plans: Gold plans offer the highest level of coverage among the listed plans. While premiums are the highest, these plans typically cover a broader range of services and treatments, potentially reducing out-of-pocket expenses for individuals with substantial healthcare needs.

- Catastrophic Plans: Catastrophic plans offer the most comprehensive coverage, but they are often used as a last resort. Their premiums are significantly lower than other plans but often come with a high deductible, meaning individuals must pay a substantial amount out of pocket before the insurance kicks in. They are best suited for individuals who anticipate minimal healthcare needs and prefer to manage most costs themselves.

Factors Influencing Health Insurance Costs

Several key factors significantly impact the price of health insurance plans. Understanding these elements is crucial for making informed decisions.

- Location: The cost of health insurance can vary substantially depending on the geographic location. Higher healthcare costs in certain regions often translate to higher premiums. This reflects the varying costs of medical services, physician availability, and other healthcare factors.

- Age: Age is a critical factor in health insurance pricing. Younger individuals tend to have lower premiums than older individuals, as they are statistically less likely to require extensive healthcare services.

- Pre-existing Conditions: Individuals with pre-existing conditions might face higher premiums, as insurers need to account for the potential for increased healthcare expenses in the future. Insurers typically use actuarial models to predict the risk of future claims and adjust premiums accordingly. These conditions include chronic diseases, injuries, and past illnesses.

Examples of Health Insurance Plans

Illustrative examples can help solidify the understanding of different plan types.

| Plan Type | Premium | Coverage | Deductible |

|---|---|---|---|

| Basic | $100/month | Essential services (doctor visits, emergency care) | $500 |

| Bronze | $150/month | Essential services, preventative care | $1,000 |

| Silver | $200/month | Comprehensive coverage, preventative care, specialist visits | $1,500 |

| Gold | $250/month | Broad range of services, including prescription drugs, mental health | $2,000 |

Navigating the Health Insurance Marketplace

The health insurance marketplace, while offering a wide array of options, can feel overwhelming. Understanding the process of finding affordable plans and comparing them effectively is crucial for making an informed decision. This section details the key steps involved, providing clarity and tools to navigate this complex landscape.

Navigating the health insurance marketplace involves careful consideration of individual needs and available options. Success depends on understanding the steps involved, comparing plans, and utilizing available resources. This process, while potentially intricate, is manageable with the right knowledge and approach.

Key Steps in Finding Affordable Plans

Finding affordable health insurance plans begins with a thorough understanding of your needs and budget. Factors like family size, pre-existing conditions, and desired coverage levels all influence the best plan. This preliminary step sets the stage for effective plan selection.

Comparing Different Plans and Understanding Terms, What is the cheapest but best health insurance

Comparing health insurance plans requires a detailed review of their terms and conditions. This includes understanding the plan’s network of doctors, the coverage amounts for various medical services, and any out-of-pocket expenses. These details are critical to ensuring the plan aligns with your needs. A thorough comparison helps avoid potential issues down the line.

Resources for Comparing Plans

Numerous resources are available to help consumers compare health insurance plans. These resources can offer insights into various plans, aiding in the selection process.

- Health Insurance Marketplace Websites: Government-run marketplaces (like the Healthcare.gov in the US) offer a centralized platform for comparing plans. These sites often provide detailed plan information, allowing consumers to compare features, costs, and coverage levels. Using these sites is a straightforward way to start the process of comparing various options.

- Independent Comparison Websites: Independent websites dedicated to comparing health insurance plans can provide comprehensive overviews of different plans. These sites frequently present plan data in user-friendly formats. They typically offer comparative analysis tools, helping consumers identify the best fit based on their needs and budget.

- Insurance Brokerage Firms: Insurance brokers can provide personalized guidance and comparisons based on individual circumstances. They can help navigate the complexities of the marketplace and find plans that meet specific needs.

Resources for Detailed Plan Information

Accessing detailed information about health insurance plans is essential for informed decision-making.

- Health Insurance Marketplace Websites (e.g., Healthcare.gov): These sites provide comprehensive information about various plans, including coverage details, cost breakdowns, and network provider lists. These are excellent starting points for researching different options.

- Company Websites: Insurance company websites often provide detailed plan information, including specific benefits, exclusions, and coverage details. These can be useful for in-depth understanding of specific plans.

- State Health Departments: State health departments may provide resources and information about health insurance plans available in the state.

Step-by-Step Guide to Choosing a Plan

Choosing a health insurance plan involves a structured approach. A step-by-step guide helps ensure a thorough and effective selection process.

- Identify Needs and Budget: Consider family size, pre-existing conditions, and desired coverage. Determine a realistic budget for premiums and out-of-pocket costs.

- Explore Available Plans: Utilize the resources mentioned above to explore different plans. Note the coverage details, costs, and network providers.

- Compare Plans: Carefully compare different plans based on the factors that matter most to you. Consider cost, coverage, and network providers. Use comparison tools and resources to simplify this process.

- Consider Out-of-Pocket Expenses: Review deductibles, co-pays, and coinsurance amounts for each plan. Understand the potential out-of-pocket costs associated with each plan.

- Choose a Plan: Select a plan that aligns with your needs, budget, and preferences. Make sure you are comfortable with the coverage and associated costs.

Strategies for Reducing Health Insurance Costs: What Is The Cheapest But Best Health Insurance

Navigating the complexities of health insurance can be daunting, especially when it comes to affordability. Understanding various strategies to reduce costs is crucial for securing comprehensive coverage without undue financial strain. This section delves into practical methods for lowering premiums, enhancing coverage, and negotiating favorable rates.

Methods for Lowering Health Insurance Premiums

Several factors influence health insurance premiums. Understanding these factors allows individuals to implement targeted strategies for cost reduction. Age, location, pre-existing conditions, and the chosen plan all contribute to the premium amount. Lowering premiums often involves a combination of factors, including lifestyle choices, financial considerations, and utilizing available resources.

- Lifestyle Modifications: Maintaining a healthy lifestyle can significantly impact premiums. A healthy diet, regular exercise, and avoiding tobacco products are key elements. Individuals with lower BMI and healthier habits tend to qualify for lower premiums. Maintaining a healthy weight and a physically active lifestyle can also result in reduced healthcare costs.

- Cost-Effective Healthcare Options: Choosing preventative care, such as regular checkups and screenings, is more cost-effective in the long run. Prioritizing preventative measures over emergency room visits and hospitalizations can significantly reduce overall healthcare costs. Individuals with chronic conditions can utilize telehealth options for routine monitoring and care, which often leads to lower costs compared to in-person visits.

- Financial Assistance Programs: Government subsidies and programs, such as the Affordable Care Act marketplace subsidies, are crucial for affordability. Understanding eligibility criteria and taking advantage of these programs can substantially reduce the cost of health insurance.

Strategies to Improve Health Insurance Coverage

Expanding coverage without significantly increasing premiums is achievable through careful plan selection and utilization. Several strategies can lead to more comprehensive coverage while keeping costs low. These strategies involve assessing individual needs, comparing different plan options, and leveraging financial assistance programs.

- Comparing Different Plan Options: Carefully evaluating different health insurance plans is crucial. Comparing deductibles, co-pays, co-insurance, and out-of-pocket maximums is essential. Choosing a plan with a lower premium but higher deductible can lead to cost savings if utilization is lower. Conversely, choosing a plan with a higher premium and lower deductible can provide greater financial protection in case of higher medical expenses.

- Negotiating Better Rates and Discounts: Negotiating better rates is possible. Some insurance providers offer discounts to employees, military personnel, or individuals who meet specific criteria. Leveraging these discounts and negotiating premiums can help reduce the overall cost.

Negotiating Better Rates and Discounts on Health Insurance Plans

Negotiation tactics can be effective for securing better health insurance rates. Understanding the insurance provider’s policies and the marketplace can help in the negotiation process. This involves researching and understanding the insurance market and comparing rates across different providers.

- Comparing Across Different Providers: Comparing rates from multiple providers is crucial for finding the best value. This process involves evaluating different plans based on coverage, premiums, and deductibles. This approach can lead to discovering a plan that offers better value for the money.

- Utilizing Employer-Sponsored Plans: Employer-sponsored plans often offer competitive rates and comprehensive coverage. Participating in such plans can lead to substantial cost savings, as employers may provide subsidies or contribute to the premium.

Selecting Plans with Lower Premiums and More Comprehensive Coverage

Finding the right balance between premium cost and coverage is essential. This process involves evaluating individual needs and understanding the available plan options. This includes understanding the different types of plans and their associated costs and coverage.

- Understanding Different Plan Types: Understanding the differences between various plan types, such as HMOs, PPOs, and POS plans, is vital. Each plan type has its own set of characteristics and cost implications. Choosing the plan that best suits one’s healthcare needs and lifestyle is key.

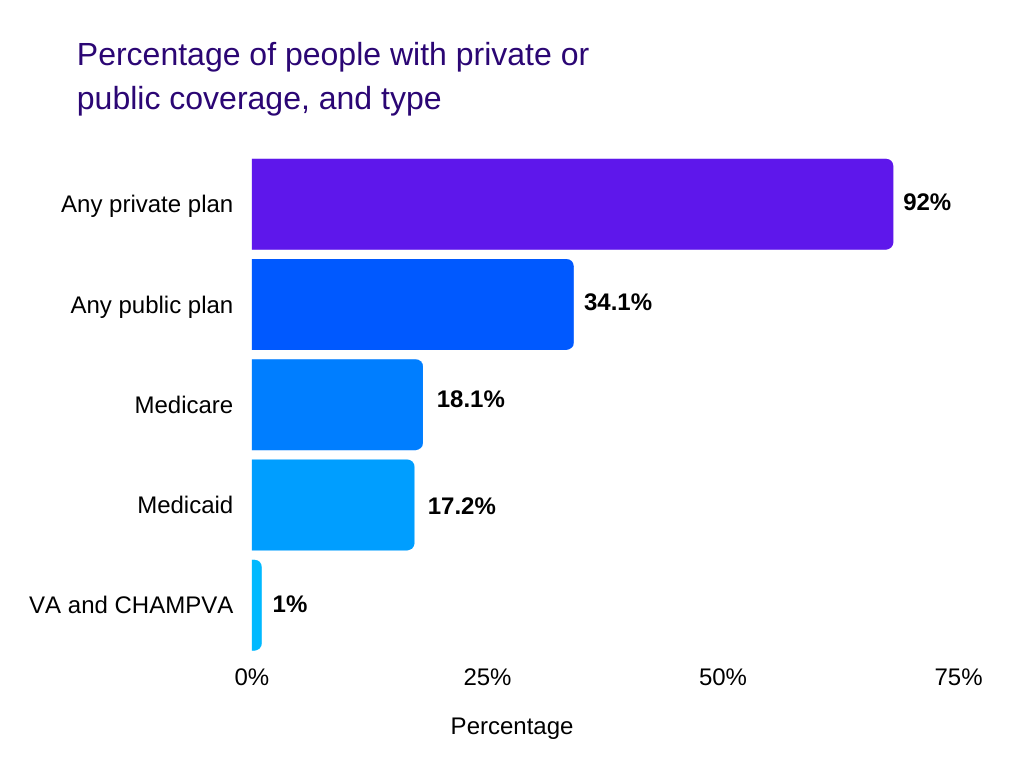

Financial Assistance Programs

Various financial assistance programs are available to help consumers afford health insurance. These programs often target low-income individuals and families. Understanding the eligibility criteria and utilizing these programs is crucial for access to affordable healthcare.

- Medicaid and CHIP: Medicaid and CHIP (Children’s Health Insurance Program) provide comprehensive healthcare coverage for low-income individuals and children. These programs offer significant financial assistance and help reduce the burden of healthcare costs.

Cost-Saving Strategies Table

| Strategy | Effectiveness | Limitations |

|---|---|---|

| Lifestyle Modifications | High, potentially reducing premiums and healthcare costs | Requires sustained effort and commitment |

| Cost-Effective Healthcare Options | High, promoting preventative care | May require some upfront investment in preventative measures |

| Financial Assistance Programs | High, reducing the financial burden of premiums | Eligibility criteria may vary and availability may be limited |

| Comparing Different Plans | High, enabling comparison of benefits and costs | Requires time and effort to research and compare |

| Negotiating Better Rates | Moderate, potentially yielding significant savings | Requires strong negotiation skills and awareness of market conditions |

| Utilizing Employer-Sponsored Plans | High, often offering competitive rates | Dependent on employment status and employer policies |

Finding the cheapest yet most comprehensive health insurance can be tricky, especially for the self-employed. Understanding the best options often requires exploring various plans and considering your specific needs. Fortunately, exploring the best way for self-employed individuals to obtain health insurance can provide crucial insight into navigating the complexities of this crucial decision. This is where resources like Best Way for Self-Employed to Get Health Insurance come into play, shedding light on the diverse avenues available and helping you identify the most affordable and comprehensive coverage tailored to your circumstances.

Ultimately, the cheapest but best health insurance depends on your personal health needs and financial situation.